What do the building, real estate, transportation, engineering and manufacturing industries have in common? They’re all about to be transformed by digital twins that will improve their decision making and operations.Digital twins help improve everything from product functionality and design to operational decision making and workflow inefficiencies. Thanks to their many benefits, it’s no surprise that a Gartner survey found 48 percent of enterprise players already employing IoT are using or plan to use digital Twin technologies by the end of 2018. But what is a digital twin, and why are forward thinking building and real estate firms flocking towards them?

What is a digital twin?

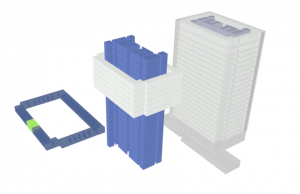

[caption id="attachment_950" align="alignright" width="366"]

An example of a digital twin of a building, created with Smart World Pro.[/caption]A digital twin is an exact virtual representation of a physical object. It’s created by connecting large amounts of data — including real-time information — to a 3D virtual model replica of a physical asset.Because digital twins are exact replicas of the physical object they represent, there are many ways to leverage their power.Imagine, for example, that you build jet engines. It’s critical that you do everything possible to make sure they work properly to keep plane passengers safe. You’ll need continual, real-time access to a variety of data from the engine to help you determine quality baselines and make data-driven predictions about future performance.With a digital twin, real-time updates from sensors on the engine show whether everything is running smoothly. If a part on your physical engine stops moving, the same part in your 3D model will stop moving, too.But digital twins do more than just show real-time data about a physical object. They make managing data from different software and file formats easier by putting it all into a single location. As a result, users save time since they don’t have to switch between software programs to view different data types. They’re also able to better put their data into context. Data is more meaningful when its analyzed alongside a variety of other types of intel.

How do digital twins help the building and real estate industries?

While digital twins are expected to revolutionize many industries, the building and real estate industries are particularly poised to benefit from their adoption. How they'll use this technology will depend on what stage of the building process — from design to management to demolition — in which the user is working. The need for digital twins originates from the fundamental industry need for more and more sophisticated dashboard tools. Users increasingly need one place to see everything they need to know about their projects or properties, simply and quickly. As the real estate universe continues to digitize and building and property data becomes more abundant and complex, the number of available tools, data formats, and data services have multiplied exponentially. As a result, synthesizing data into actionable information has become increasingly difficult. Despite the massive shift in data volume, complexity and sheer number of formats, software dashboards continue to rely on old school bar graphs and pie charts to visualize information that ignore the majority of the tools and data services that building owners now rely on. A digital twin dashboard visualizes and analyzes this data, making it easier to understand and act upon property information.A digital twin earns its ROI from multiple sources over its lifecycle. In the early stages, users find value by optimizing planning and design functions. Later on, its found by streamlining building energy and maintenance functions. Users also find digital twins improve sales and tenant satisfaction.

Digital twins for architects, engineers and planners

Digital twins give architects, engineers and planners a powerful way to visualize a project and connect it to real-time data.For example, architects can use digital twins to figure out the best placement of a building's front entrance. Using real-time data and other intel collected by the digital twin, along with proprietary information belonging to the architecture firm, they can look at information like pedestrian foot traffic on each street that borders the perimeter of the building to determine where an entrance would be most accessible in the building. Of course, that’s just one example of what you can do with the real-time data available through a digital twin. Users can to make smarter decisions based on data when they see it in the context of their project. Users can import a host of data into their digital twins, including zoning, permitting, traffic, crime and air quality data. The more data that's available, the more each data point complements another.

Digital twins for property managers and owners

Property managers and owners also find value in digital twins. Unlike architects, engineers or planners — who use the technology to make decisions during the planning and design phases of a building — property managers and owners are able to leverage digital twins to optimize operations and sales. It can be helpful for property managers and owners to think of digital twins as “BIM for owners.”Property managers interested in reducing energy consumption find digital twins to be incredibly useful. They can quickly see how much energy is being used by each tenant and make a data-driven game plan to reduce energy usage throughout the building thanks to the real-time data from sensors throughout a building, like those connected to their HVAC and lighting.Property owners can use digital twins as a tool to help enhance sales. When faced with questions from a prospective buyer or renter, agents can turn to their digital twin for answers. Agents close deals more easily when they have access to all of their property information.

What’s next?

The building and real estate industries are well suited for the aide digital twin technology provides. Major players in the industries have already begun to incorporate digital twins into their software stack. Expect to see a rapid increase in implementation as firms realize the technology is critical for success.