Major surge in share price at leading Digital Twin company Cityzenith after huge revenue increase

Forecasts that the Digital Twin market will grow 58% a year to $48.2bn by 2026 (MarketsandMarkets) have helped stock in Cityzenith rocket from $0.575 cents to $1.50 per share in just five months.

Cityzenith was also named as one of the sector’s leaders alongside Siemens, Philips, and Microsoft in various market reports over the past year.

The share price rise follows major contract wins in the Middle East, US and Europe as well as a $2.5m surge of investment in the Chicago-based company since late 2020, when Cityzenith launched a $15m Regulation A+ crowdfunding investment platform on its own website.

It has now passed the 5,000-investor milestone and raised over $9m since inception and this funding will support Cityzenith’s growth trajectory and a $9m revenue pipeline of international Digital Twin projects for 2021.

These include a large and ground-breaking de-carbonisation energy project in the US, prestigious $1m Middle East contract, US government agency project, and a strategic partnership that helps commercial building owners achieve carbon neutrality in 23 major cities. The company’s technology is also well positioned to help enable President’s Biden’s post-COVID ‘Build Back Better’ Plan.

At least 56 investments deals were completed for Digital Twin companies since the start of 2020, totalling $284m (source: Pitchbook) during the pandemic and Institutional investors are now also investing directly in Reg A+ rounds alongside VCs, PEs, accredited investors, and non-accredited investors.

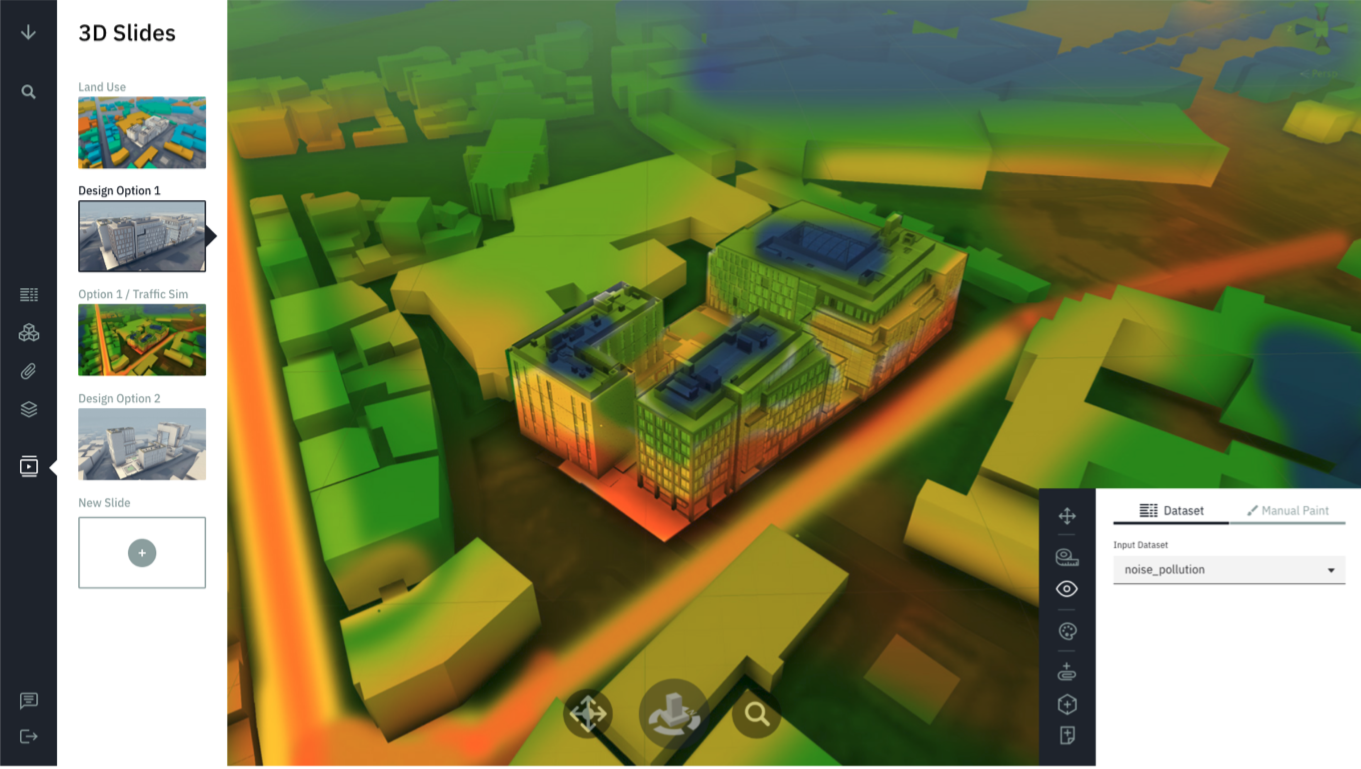

“The Digital Twin market is taking off and our regulation A+ capital raise is flying too,” said Cityzenith founder and CEO Michael Jansen. “The injection of extra funding will allow us to fully exploit new contracts and wider opportunities quickly opening up for Digital Twins; 3D virtual replicas of buildings and infrastructure optimising design, construction, and operational management.

“Our user-friendly SmartWorldOS platform is unique in its flexibility and ability to work with almost any existing technology and data and tackle projects of any size - building, campus, district, city, county, state, country - while other companies still try to repurpose old software or sell managed services originally designed for modelling buildings, not whole cities or mega-projects.

“We were ahead of our competitors with our investment in R&D before launch, building our tech platform alongside major partners such as Cushman & Wakefield, Foster + Partners, CBRE, and Atkins Group. Our market strength is now recognised with every release of our software, leaving the ‘competition’ further behind the development curve.

“We are on a mission to become the iPhone of the city Digital Twin market, delivering a curated, customized, consistent platform experience to our discerning customers that puts an extraordinary amount of information and functionality into the hands of the people entrusted to design, build and run sustainable cities.

“We launched our ‘Clean Cities - Clean Future’ campaign last year and pledged to donate Digital Twins to key cities to help them help their commercial building owners eliminate carbon emissions. We plan to announce the first few participating cities soon.

“We have a goal to announce more contract wins shortly that will impact our revenues for the next 5-10 years. We have won international awards for our work in Digital Twins and smart city infrastructure, including Manufacturing Technology Insights ‘Top 10 Digital Twin Provider’, a Realcomm Digie Award, World Smart Cities Award, and Chicago Innovation Award, while also named as a “leading Digital Twin practitioner” by the BBC, in addition to 1,000 mentions in Forbes and other major media over the past year.

“Last week Cityzenith was the only Digital Twin company chosen alongside nine other US innovators to join a NASA ‘Ignite the Night: Aeronautics’ event. NASA engineers were keen to learn how SmartWorld might enable safe future travel and transport in the airspace above our cities, using thousands of electric-powered drones and air taxis.

Shareholders have reacted positively to Cityzenith’s news, with comments including:

“Cityzenith is well positioned to consolidate its end of the Digital Twin market, which Gartner has called one of the top 10 tech markets in the world to watch for the last three years running. The founders of Google Earth and Revit Technologies were behind this in the early days, and their CEO is one of the best in the business. Many companies are talking about developing Digital Twins now, but Cityzenith is past all that and is executing contracts.”- Dr. Yousef Siddiqui (US-based medical consultant who has backed Cityzenith with a $2m investment)

“I invested in Cityzenith to be a part of the transformation from just existing in this world, letting what happens happen, to being an active participant in sustaining and living in this world. Cityzenith is transforming properties, communities, and cities across the globe to help all people to live in a cleaner, safer environment.” - John Turbeville, CFO, Triglobal Energy, Texas (renewable energy developer)

“I am invested in 43 early stage companies and I believe that Cityzenith has one of the best chances to be an industry disrupter, which will benefit the industry, the users and the investors.” - Ronald Hopwood, Retired Doctor, Florida

"I base all my investments on three main principles. How good is the product? How big is the market? What does the team’s track record look like? If it impacts positively the world in any way, even better. Cityzenith was an obvious winner in all four, and is an early leader in a space where other companies have achieved unbelievable valuations.” - Domenico Ranucci, General Manager, Insighting Business Advisers Ltd, London

“Cityzenith is recognised as one of the leaders in the Digital Twin market that has crossed the Rubicon from an industry specific tool to a multi-million dollar arena that leverages the new drivers of advanced urban digital transformation such as AI, VR, ML and Deep Learning.” - Joe Dignan, Head of Government Insights Europe, IDC, London

“Technology is all around in this world and there is no reason why this can't spread into architecture and construction. This company is at the forefront of this initiative and shows no signs of slowing down. As the population of the world continues to grow we will need more creative and inventive integrated city planning and operational management tools. If you want to invest in the Wright Brothers of the Digital Twin genre this is the one to choose.” - Richard Halprin, infrastructure IT manager, New York

.jpg)